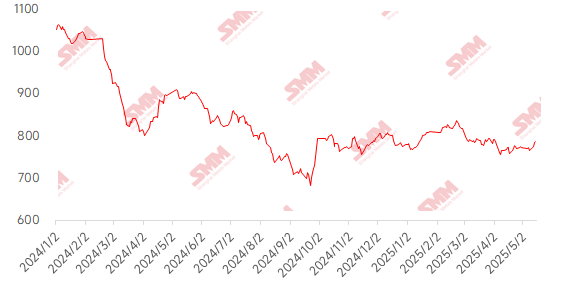

This week, the imported iron ore market surged significantly before pulling back slightly. On Monday, the "Joint Statement of the China-U.S. Geneva Economic and Trade Talks" was released, with both sides agreeing to substantially reduce bilateral tariff levels and each retaining a 10% tariff. Since February, market sentiment regarding tariff wars has improved significantly, stimulating a sharp rise in iron ore futures. Subsequently, a port equipment accident at a Peruvian iron ore company, requiring 4-5 months of repairs, raised market concerns about future supply reductions, pushing iron ore prices to new highs. However, from a fundamental perspective, port arrivals increased slightly this week, while daily average pig iron production fell by 17,000 mt this week, starting to decline from high levels. Iron ore demand pulled back slightly, suppressing spot prices and significantly narrowing the futures-spot price spread. Regarding port prices, the price of PB fines in Shandong rose by 15 yuan/mt WoW.

Chart: SMM 62% Import Ore MMi Index

Source: SMM

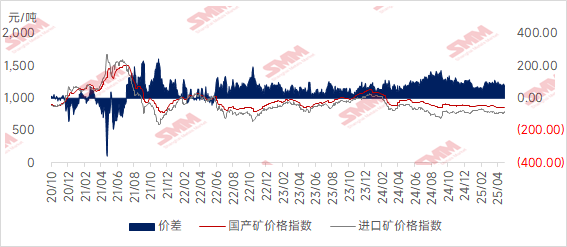

Domestic ore prices rose slightly this week, and it is expected that domestic ore prices may continue to rise next week. Among them, prices in Tangshan, Qian'an, and Qianxi areas of Hebei increased by 5-10 yuan, while prices in Chaoyang, Beipiao, and Jianping areas of west Liaoning, as well as in east China, increased by 1-5 yuan/mt.

Iron ore concentrate prices in Hebei remained relatively stable, with the dry-basis, tax-inclusive delivery-to-factory price of Fe66% iron ore concentrates in the Tangshan area ranging from 945-950 yuan/mt. Currently, mines and beneficiation plants have a strong sentiment to stand firm on quotes, with a strong short-term bullish sentiment and no urgency to sell. According to SMM tracking, there have been no maintenance operations at steel mills' blast furnaces recently, and pig iron production remains at a relatively high level, providing some support for local iron ore concentrate demand.

Iron ore concentrates in west Liaoning rose slightly, with the wet-basis, tax-exclusive ex-factory price of 66% grade iron ore concentrates ranging from 710-720 yuan/mt. Local safety inspection efforts have weakened, and previously halted mines and beneficiation plants have gradually resumed production, slightly alleviating the short-term supply tightness trend. On the steel mills' side, purchasing as needed is currently the main approach. Recently, there have been market rumors about crude steel production restrictions at local steel mills, but according to SMM's current tracking, the possibility of production restrictions in the short term is low, providing some support for local iron ore concentrates.

In east China, most mines and beneficiation plants are currently operating normally as planned, selling as they produce. Some mines and beneficiation plants are facing certain inventory pressure, and local steel mills are mainly purchasing as needed, with overall market transactions slowing down. However, from a pricing perspective, the average price index of imported ore rose slightly WoW this week, and it is expected that there may be some upside potential for local iron ore concentrate prices next week.

Chart: Price Spread Between Domestic and Imported Ores

Source: SMM

Outlook for Next Week

For imported ore: Recently, overseas shipments have been at a moderately low level. Affected by the port accident in Peru, it is expected that overseas shipments will have limited improvement next week. The overall supply pressure is relatively small. According to SMM's blast furnace maintenance plan, the daily average pig iron production is expected to decline by approximately 10,000 mt next week. Although pig iron production has started to weaken, the overall decline is relatively small, and production remains at a high level. The demand for iron ore continues to support ore prices. Considering the suspension of China-US tariffs and the relaxation of steel export restrictions, which are positive for the entire ferrous industry chain, market sentiment is expected to remain optimistic. SMM expects iron ore prices to continue to hold up well next week. However, the policy to reduce crude steel production has not yet been implemented, which will still exert downward pressure on ore prices.

From the perspective of domestic ore: Overall, the fundamental situation of domestic iron ore concentrates is relatively stable. In terms of news, the China-US tariff negotiations have been relatively smooth, boosting overall market confidence. Coupled with the strengthening of the futures market for imported iron ore, it is expected that domestic iron ore concentrate prices may have some upside potential next week.

》Click to view SMM Metal Industry Chain Database

![Before the holiday, the black chain is unlikely to see a trend-driven market [SMM Steel Industry Chain Weekly Report].](https://imgqn.smm.cn/usercenter/zUFfM20251217171748.jpg)

![[SMM Chromium Daily Review] Inquiries and Transactions Weakened, Chromium Market Showed Mediocre Performance Before the Holiday](https://imgqn.smm.cn/usercenter/ENDOs20251217171718.jpg)